As I sat watching the last sunset of 2023, musing over the year it was, it occurred to me that the year has been a phenomenal one for stock market watchers.

While the individual stories may differ, there would be a general consensus that the year has given above average returns to hard core professionals and absolute novices , alike .

So , is the stock market turning attractive to the public ? Is everyone trying to get into stocks and mutual funds ?

Curiosity kindled , I turned to Google for some quick figures.

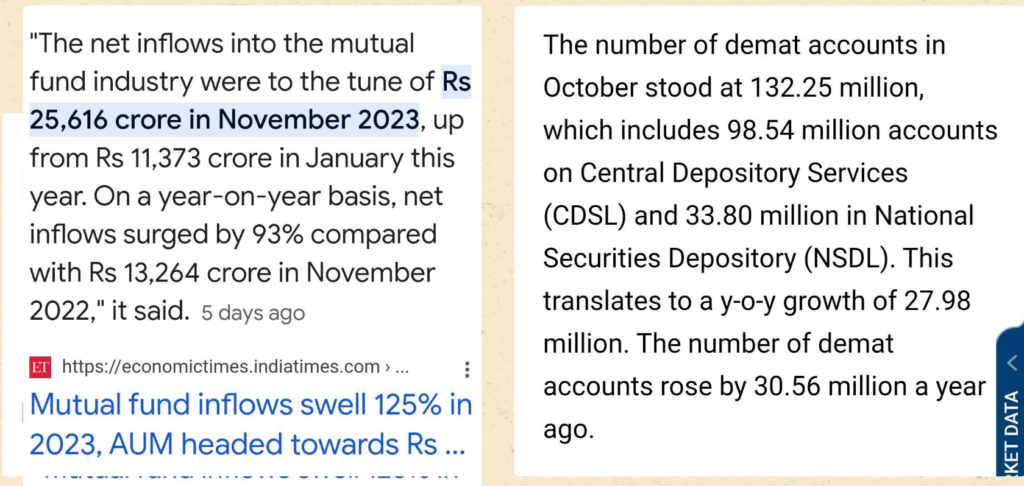

As expected, the MF inflows have increased by 125 %.

The number of demat accounts increased by 27%.

So is it going to be many happy ‘returns’ year after year? Are all the new investors going to be blessed by 15-20% annualised returns for rest of their lives?

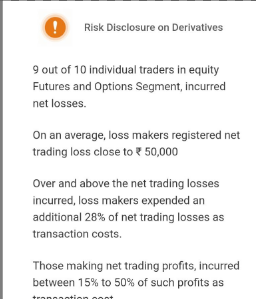

The investment world seems to be a happy place and yet we keep seeing threatening, mandatory information wherever you try to enter .

Anecdotes abound in many a family about uncles (never aunts) who went bankrupt due to Dalal Street.

There are many who believe, not without reason , that stock markets are gambling dens .

So, what’s the truth ?

Who makes money and who bites the dust?

I am sure many would have come across the book ” Psychology of Money ‘ by Morgan Housel.

The author states emphatically that it’s all in the mind .

That’s the theory and today I saw it in the real world.

A friend of mine has a mutual fund portfolio created for him by somebody who is now not available to monitor the same.

The friend never bothered to check how his investments were faring.

I , a confirmed technology addict cannot refrain from checking through various apps and websites on how my modest portfolio was faring . At times it happens thrice a day and gets too boring despite the high that Dalal Street gives.

Looking for something to do, I casually enquired the friend about his portfolio and as expected I got an indifferent reply.

With some effort and the magic of internet I could compute his returns in minutes.

It was a ‘Wow’ moment as the last nine months had given him a whopping 50 % returns and he was not even aware of it. In simple terms, at this rate, his money was getting doubled in a year and a half.

That’s the kind of returns any mutual fund manager would be proud of any day.

What did he do right? He just left it alone by design or default.

What happens when you don’t leave it alone?

A human mind is hardwired to lose money in stock markets, sometimes at an astonishing pace.

When the stock / MF moves up a 10% the fear of losing that 10% says ‘ sell , sell !’

When it moves another 10% , (after you have sold) the fear of missing out and the greed for more says ‘buy buy !’.

So, one keeps buying high and selling low. In a bull market , this only minimises the profits while in a bear market , this phenomenon can wipe out your capital.

Smart people use technology to quantify everything ,including emotions !

The market mood index is supposed to show the dominating emotions. Theory says , that a smart investor should buy when the public is in panic and should sell when the public shows avarice.

Will it work ? Unfortunately No.

As on date (01 Jan 2024) , Tech pundits say it’s Greed that is dominating. Suppose this image goes viral among investors and the multitudes start selling , the indicator itself will be affected showing ‘fear’. That would mean ‘start buying’.

So in the age of technology and social media any action based on these indicators will influence the indicator itself !

So, what’s the way out to beat the street , in case you want to be fully invested in the stock markets directly or indirectly?

There are two options :-

The difficult way is to be Buddha like or as a karmayogi would say ‘ be like the water on Lotus leaf; be there but totally detached ‘. See the ups and downs and the wild swings but don’t give in to greed or fear. It’s easier said than done.

A more human way would be to just invest and forget about it ; and probably that’s what my friend did right .

It would be fun to see how the new investors behave in a bad year.