When I say, I trade in equities , the first question I face is “where do you get tips from ” . Or it could be “give some tips , na” . No tips, No trading; so it sounds.

Tips can mean anything . Peter Lynch says in his book; When two fund managers run into each other, may be in an office corridor, the first conversation after hello would be “hey, what are you looking at ” and the response could be “there’s something happening at General Motors ” or “may be a buy back offer at abc company…..” . That’s what fund mangers do; keep tabs on the businesses”. Tips could also mean precise directions to trade; buy ABC at 683 for 5 months period; target 790 and stop loss 627.

It is the latter connotation one is more familiar with . Everyone wants someone else to hook the fish so that you can pose with catch proudly.

I just fail to understand how such tips can work in practice. Even if seven out of ten such trades work, anyone can become a millionaire just by following these directions, precisely. There would be minor losses and major gains as the losses incurred would be just 20-30 % of the gains accrued when the target is hit.

But does it really happen ? Obviously not. Even paid advisory services , which are dime a dozen do not have the kind of hit : miss ratio that can keep you in the positive zone, leave alone make you a millionaire.

Ironically , when people find that the system does not work, they hardly blame the method , but just attribute the losses to bad tips or poor implementation. So, the chase for the holy grail called ‘Good Tips’ resumes.

There are people who swear by fundamental analysis and there are others who take technical analysis as Gospel Truth . The Fundamental Analysts go through earnings, past present and future, the book value , and whole host of ratios to come out with one number that would be the price target in next 12 months. As a rule the targets given by the analysts vary from -20% to + 20% with all kinds of recommendations , buy, hold or sell. Here’s one after the recent Q2 results

As for technical analysts , they pour over charts and a dozen indicators and prophesy the future course of the price movements. Here, the variance is even more pronounced. On the TV Channels, if there are three technical analysts , there are six opinions. Why six ? After all each sentence is followed by , “if this, then that ” and “having said that ….” Most of the time the second part of the opinion totally negates the first part.

This is the research based on which TV Channels provide precise directions down to a rupee for buy price and target price. Some channels make it more interesting by going for fancy formats like 20-20 after the 20-20 Cricket.

In reality about 50% of the tips would be productive, which is also the probability of flipping a coin and calling right .

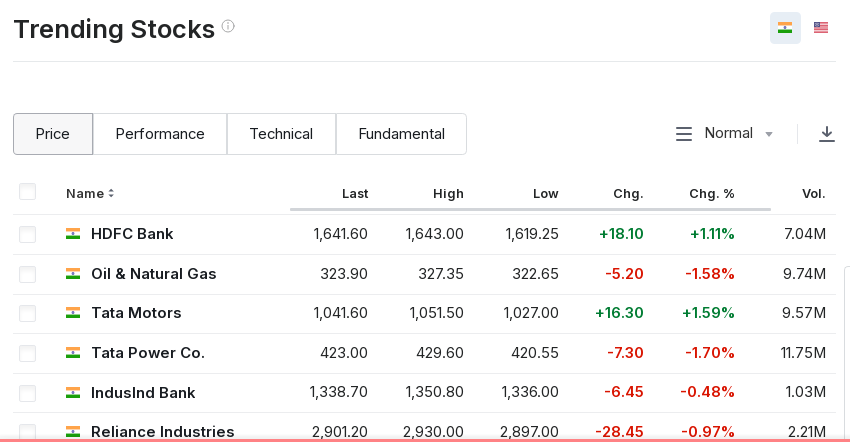

So, the question is do traders need tips at all . One can easily find 10-20 tradable stocks from any of the web sites on stocks. They give real time inputs on prevailing trends. Here’s an example

Assuming that people need the name of a stock to start with and all are not net savvy, (Though all are TV Savvy) we come to the next question; how to use these tips. Some follow it to the letter; there are others who partially follow. Then there is another class of people who take a totally contrarian call on the view that the entire herd would go in the direction of the tips while they could runaway with the booty by taking the opposite direction!

Be that as it may, in my view, most tips are only as useful as a coin unless it is insider information which is illegal anyway.

So, what’s the way out ? There are many methods to make money in the market and probably even more ways to lose money . As I see, one has to find a way that works for himself or herself. A lot depends upon the time available, money available, risk appetite , loss aversion, mental discipline, ability to focus and the state of one’s nerves. Of course some principles may be applied almost universally.

Some principles that I can think of :-

- Fundamental Analysts tell you what to buy and Technical Analysts tell you when to buy.

- Technical analysts’ recommendations work only for short term trades and fundamental analysis would need to be done every quarter or on occurrence of fresh inputs on the business .

- It is better to book a small loss when the trade does not go your way, rather than wait for the loss to go bigger by which time one becomes even more reluctant to book a loss. Will power does not work in the face of bad business or bad sentiments. Yes, sentiments are as important as the business.

- Averaging is bad . I am surprised by many experts on TV Channels advising traders to average. Your holding a particular stock should not influence your buying decisions. If you would buy a stock irrespective of whether you are holding it or not, then sure go ahead and buy. Averaging to mean, buying more of the same stock, is no method to reduce the loss you have already incurred . The loss can be recovered through any other trade. Of course, if you are not sure of the right price for a stock, you can buy it in small lots to average. The risk and reward , both are reduced.

- Never ever convert your short term trade to long term one or vice versa, just because the trade is not going your way in the originally intended period. For long term or short term, the type of stock and size of positions would vary a lot.

- Money management is often overlooked. Trading is a risky activity and only solid money management can cover the huge risks inherent to trading. As I view, one needs Solid Blue chips stocks to provide stability to a portfolio, then mid and small caps to provide growth and liquid cash to exploit the opportunities and to mitigate losses in case of a crash. For example a conservative trader could have 60% in blue chips 20% in mid caps and remaining 20% in cash at any given time.

- Mental Discipline would be the single most important factor that separates successful traders from the not so successful. Good traders book their losses when they go wrong and let the profits run when they are right. Amateur traders who are too reluctant to book losses and too eager to take home the profits end up doing exactly the opposite. They let the losses run and cut short the profits.