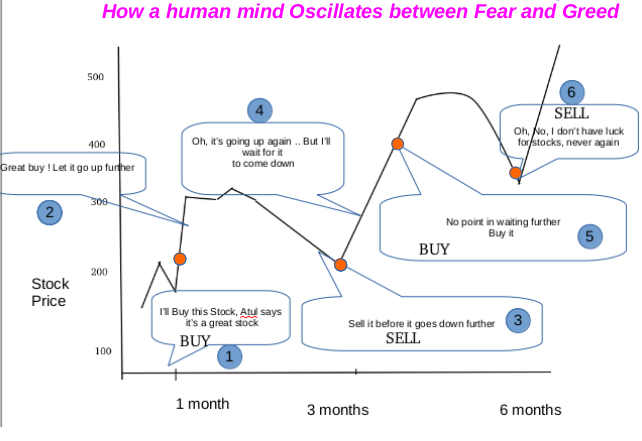

Human Mind is hardwired to lose money in Stock markets. There is a perpetual oscillation between greed and fear, that influences any buy/sell/hold decisions. (hold is also a decision , remember our late PM PV Narasimha Rao) I have attempted an illustration of the human mind while dealing with stocks. (pic 1)

Human Mind is hardwired to lose money in Stock markets.

If one is to succeed there is a need to detach human mind from our buy / sell decisions.

Another example of how an automated system is better suited to certain situations

You come back home tired , late at night and ask your Mom to wake you up early for an important meeting . Then you find in the morning you are late, having overslept. You ask your mom and she says sweetly, “you were sleeping so soundly that I didn’t have the heart to wake you up” … Ok , it would have been a different matter had you asked your wife. She would have taken it as a great opportunity to pour a bucket of cold water on your head ! Under the circumstances an alarm clock , set to multiple rings , would have solved the purpose wonderfully, sans emotions.

So we come to SIP or Systematic Investment Plan .

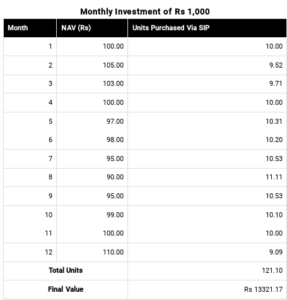

Many of us would have come across tables to illustrate how investing through a Systematic Investment plan is superior to investing a lump sum.

Two options are compared through the table; lump sum investment of Rs 12,000 at the beginning of a 12 month period and monthly investment of Rs 1000/- for 12 months. The SIP route has resulted in getting an addition unit of MF for the same cost price even though the amount invested is in installments. You get more units when the market is down and less units when the market is up. It is also called Rupee Cost averaging.

A point to note is that this is not always the case. In a bear market, SIP is more efficient and in a bull market SIP may actually result in getting less number of units. Ideally one should invest in a lump sum when the market has bottomed out. But the catch is that Nobody knows when the market has bottoms out. In 2008, No one knew , that the market was at its peak and in 2009 No one knew that it had bottomed out. If an investor had got out of the market in Jan 2008 and re-entered anytime between Oct 2008 and Mar 2009, he would be sitting on a huge fortune today. But that is hindsight. In reality most people sold out in mid 2008 at a loss after waiting for a reversal and were scared to re-enter till 2012 when the market was already up. Some are still keeping away and are just coming back in trickles in 2017-18 .

If an investor had got out of the market in Jan 2008 and re-entered anytime between Oct 2008 and Mar 2009, he would be sitting on a huge fortune today. But that is hindsight. In reality most people sold out in mid 2008 at a loss after a long painful wait for a reversal and were scared to re-enter till 2012 when the market was already up. Some are still keeping away and are just coming back in trickles in 2017-18 .

It’s like riding a roller-coaster ride blind-folded; you can’t brace yourself for the ups and downs. For a deeper understanding click here

It’s like riding a roller-coaster ride blind-folded; you can’t brace yourself for the ups and downs. For a deeper understanding click here

More important than the arithmetic, it is the detachment of human mind that makes SIP great. When I first started regular investments in MF, it was during the bull run post 2004 elections. Then in 2006, there was a slump and every stock, every Mutual Fund started heading south. I had a tech heavy portfolio and these stocks lost wealth faster as dollar was depreciating against rupee. My first action was to redeem my MFs. Why should I actually pay someone to lose my money ?

More important than the arithmetic, it is the detachment of human mind that makes SIP great.

On hindsight , I had made two big mistakes. Firstly, I had compared the MF performance in absolute terms and not with its benchmark Index. These MFs were still losing money slower than their benchmark indices and so, were still performing great. The second mistake was that while I was prepared to invest at higher NAV while I was hesitating to do so at lower NAVs.

Stock market pundits would tell you that , 10 shares of Infosys bought at IPO at Rs 95/ per share (all of Rs 950/) in 1993 (it was under-subscribed) would now be worth over 50 lakhs. So is it with the wealth created by Wipro or Reliance. I wonder how many of us have met any person who have actually benefited from such an investment. On the contrary, prior to Harshad Mehta scam, the same shares Infosys and Wipro had reached astronomical prices with three figure PEs and many investors lost big-time as the bubble burst. I am sure we would have met some of these investors . In short, big losses are real while big profits are hypothetical and on hindsight.

In short, big losses are real while big profits are hypothetical and on hindsight.

Sundaram Finance undertook an exercise to identify the beneficiaries of one of its top performing MFs Sundaram Select Midcap Fund. The idea was to honour these people in their AGM to highlight the importance of long term view on investments. It had given 5400% returns in 15 years since launch. After a lot of digging into their databases they could physically identify only a handful of investors. Half of these were dead and the others were not aware that they were holding these valuable assets. They were the only people who created wealth through long term investment ; the dead and the duds. So, if you want to make money through stock markets, after investing, be dead to the market or just be unaware, forget about the market; easier said than done.

the only people who created wealth through long term investment ; the dead and the duds. So, if you want to make money through stock markets, after investing, be dead to the market or just be unaware, forget about the market; easier said than done.

More than anything, an SIP ensures that you are not affected by the swings in the stock market . It goes like the steady tick-tick of a grandfather’s clock even though a storm may be raging all around. I’ll conclude with my personal experience on the effectiveness of SIP.

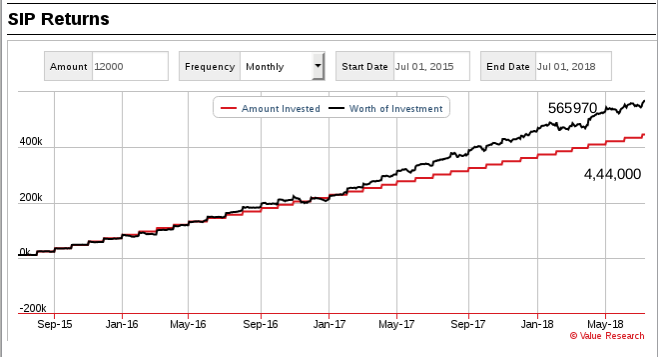

Most of us are used to the monthly subscription we make to some kind of provident fund , partly to avoid paying higher income tax. Provident Fund gives about 8 % returns and there is a tax rebate. After retirement in 2012, I started investing in ELSS (Equity Linked Saving Schemes) through SIP. Last year I had invested in Axis Long Term Equty Fund . I get the same tax rebate as someone who invests in PPF, and the returns given by the MFs are about 12-18% annualized. Since there is a lock-in period of three years , it is a forced long term investment. Pic

Note that there is no growth for the first year and a half but it is made up subsequently. Normally , a human mind is susceptible to intervene in such situations, often to a disastrous effect.

The only thing which is always true in a MF brochure is the mandatory disclaimer : Mutual Funds are subject to market risks ; …. Past performance of a Fund is no guarantee for future returns.

We know from the historical data that Market rewards long term investors. We also know from anecdotal evidence that most people buy high and sell low. It is not the people , but their emotions , greed and fear that make the buy / sell decisions. Detach the emotions from investment decisions and you have SIP.

Next we see how individual MFs are evaluated.

After investing , unlike Stocks, there is no need to monitor on daily basis as that is what the Fund manager and his team are paid for. However, at-least every quarter one should have a look at the portfolio to decide on ” buy , hold or sell”. If due diligence is done before buying, there would be no need to churn the portfolio too often.

After investing , unlike Stocks, there is no need to monitor on daily basis as that is what the Fund manager and his team are paid for. However, at-least every quarter one should have a look at the portfolio to decide on ” buy , hold or sell”. If due diligence is done before buying, there would be no need to churn the portfolio too often.